How CVS Transformed Its Retail Operations with Pipeline by Tactiq

Like many small retail stores, CVS relies heavily on the direct-store-delivery (DSD) model to maintain a consistent supply of consumer product goods on its shelves. This model brings unique challenges for retailers, requiring timely support from and constant communication with many independently operated distributors to keep shelves stocked.

Challenge

Out-of-Stock Conditions

CVS, like many national retailers, is always looking for new solutions to address repetitive out-of-stocks. The obstacle, as a small-format retailer, is that CVS needs to communicate with many direct-store delivery (DSD) vendors each week – a task that can take up to 3+ hours just to keep up with out-of-stocks.

When it comes to DSD products, CVS can be at the mercy of distributors and manufacturers to get products back on the shelf. And if those DSD vendors don’t deliver their products on time, the result is lost sales and disappointed customers.

Lack of Visibility & Transparency

With individual stores managing upwards of ten unique vendors and many more SKUs, it’s difficult to know exactly what’s been communicated to which vendor, and when. This lack of visibility and awareness can lead to miscommunication. Oftentimes, it’s easier to just wait for the next delivery to show up.

The Result

After using Pipeline and leveraging its retail team to create habits around scanning out-of-stocks, the CVS team saw a 10.8% increase in CPG sales.

CVS saw a DSD product sales lift in the millions, just by having associates complete a simple, 10-minute-a-week scan.

The implementation of Pipeline at CVS marked a significant advancement in managing retail operations. It effectively addressed the challenges of out-of-stock conditions and distributor management, resulting in enhanced efficiency and improved relationships between CVS and its distributors.

To discover how Pipeline can help your store improve efficiency and profitability, schedule a demo today.

The Solution

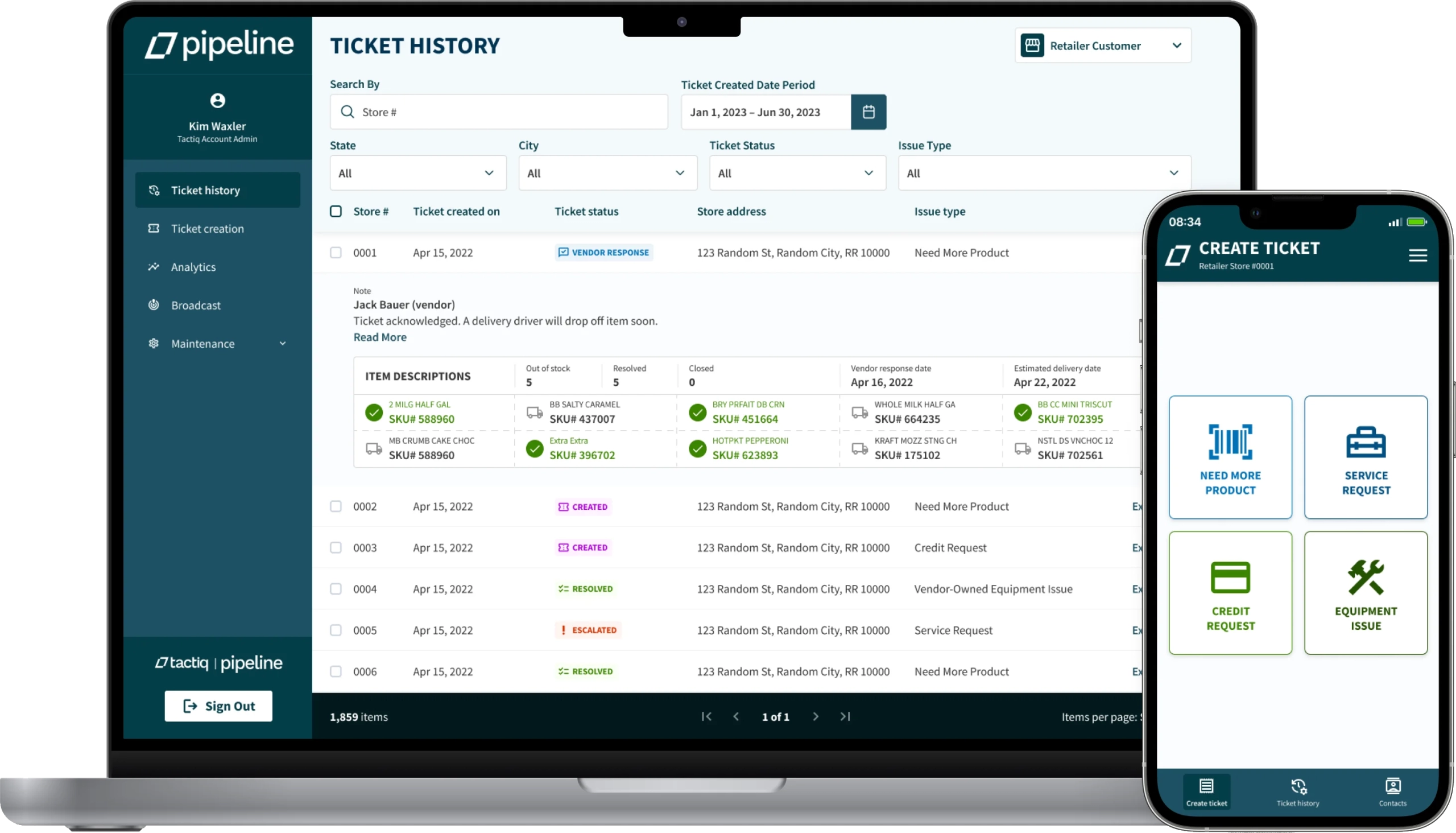

After implementing Pipeline chain-wide, 85% of CVS stores are now conducting weekly scans using the Pipeline app for out-of-stock DSD products, creating more efficient direct-store-delivery operations.

It’s working because the store management teams are voting with their time.” — Sr. Director at CVS

Benefits CVS is experiencing

Transparent Communication Process

Pipeline helps retailers better manage DSD product sales:

- Objective Scorecard and Benchmarking: Pipeline enabled CVS to objectively compare distributors through consistent metrics (i.e time from out-of-stock (OOS) notification to vendor resolution), leading to improved accountability and performance. As a result, CVS has seen a 55% reduction in time to resolve out-of-stocks.

- Improved Visibility into Shelf Conditions: Pipeline’s centralized communications platform provides all sides of the supply chain with a single source of truth on each product and its delivery status, enabling more effective service and communication.

- Example: A large frozen food distributor leveraged out-of-stock scan data from more than 1,500 CVS stores across multiple states. This data pinpointed a regional underperformance issue, allowing the distributor to resolve delivery delays, improve communication within that region, and strengthen their relationship with CVS.

Enhanced Metric Tracking

Pipeline’s robust dashboards, integral to CVS’s retail strategy, provides essential metrics for streamlined operations:

- Communication Timestamps: Precise records of when and what is communicated with distributors, enhancing clarity and reducing misunderstandings.

- Time to Deliver: Monitors the time from out-of-stock reporting to in-store delivery, which is vital for maintaining vendor service accountability.

- Trend Analysis: Informed forecasting and push-pull metric analysis helps make data-driven DSD inventory decisions.

- Bad Tag Analysis: Identifies in-store tagging inconsistencies, ensuring accurate DSD inventory management and shelf pricing accuracy.

- Lost Sales Impact: Tracking the length of time DSD items are out-of-stock allows the retailer to quantify the actual dollar sales impact of each missing item based on their historical rate of sale. This visibility helps quantify for the distributor the potential monetary gain by improving service.